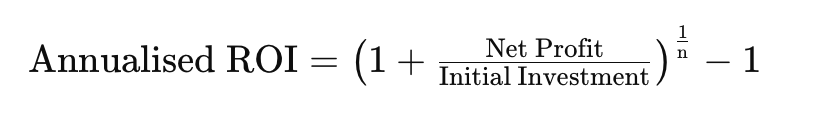

Annualised ROI is a version of the return on investment metric

that adjusts the ROI calculation to reflect the return per year.

This is particularly useful for comparing investments of

different durations, as it provides a standardized way of

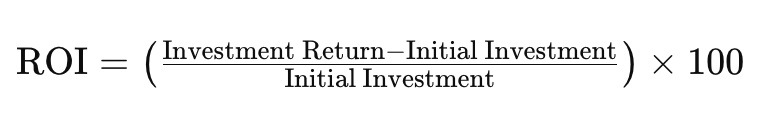

evaluating investment performance over time. While simple ROI

gives a snapshot of the total return relative to the initial

investment, annualised ROI breaks this down to an average annual

figure, making it easier to compare investments over varying

time frames.

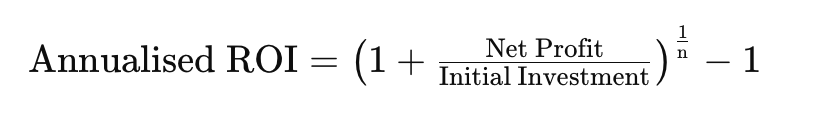

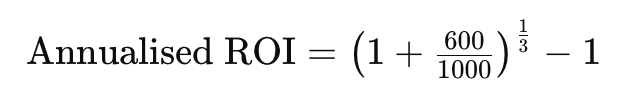

The formula for calculating annualised ROI is:

where:

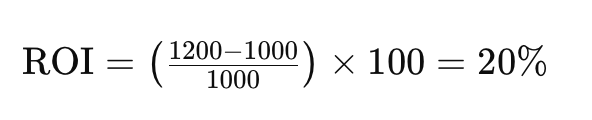

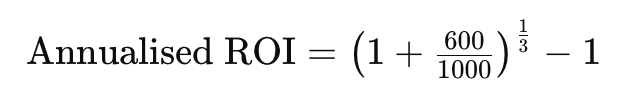

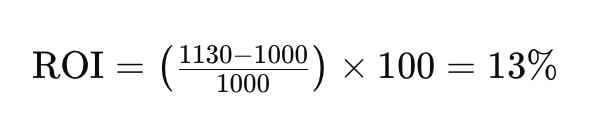

For example, if you invested $1,000 and received $1,600 after 3

years, your simple ROI would be 60% ($600 profit / $1,000

initial investment). However, to find the annualised ROI, you

would calculate it as follows:

This calculation provides a rate that expresses the yearly

return, offering a clearer view of the investment's performance,

especially when comparing investments of different lengths.

The key difference between simple and annualised ROI is the

consideration of time. Simple ROI does not account for how long

an investment is held, which can significantly impact an

investor's perspective on investment efficiency. Annualised ROI,

by standardizing returns to an annual basis, allows for a more

apples-to-apples comparison between investments, regardless of

their duration.

Annualised ROI is particularly important in the context of

long-term investments, such as mutual funds, retirement

accounts, or any investment where the funds are committed for

several years. It helps investors understand not just the total

return they can expect, but how that return translates into an

average yearly gain, providing a clearer picture of the

investment's potential growth over time.